Private Lending Airtable Base

All-in-one Airtable private lending template to manage your lending business. Loan origination, servicing, CRM, and more.

Made by a lender, for lenders.

Lend smarter

My story about the Lending Base

I started a hard money side hustle 3 years ago when I was working until 2 am every night as an investment banker. I closed 40 loans in my first 12 months. So how did I keep up and grow so fast?

I built this Airtable base to automate and cut down on 90% of the data entry and back office tasks.

I am now a full-time private lender and owner of Longleaf Lending. I've closed over 400+ loans and over $100 million in deal value. This Airtable base STILL runs my business.

Private lending software is expensive, inflexible, and cumbersome (believe me - I've demo'd most of them). You'll pay $1,000+/month plus $5,000 in onboarding and set up costs.

And then, it takes over a month just to get up and running! Most lenders don't need this.

If you want to start lending or are still using an excel spreadsheet to manage your business, it's time for an upgrade.

Built on Airtable

What's included?

The base is built in the free version of Airtable. Here's what you get:

- Instant access to my all-in-one custom Airtable base.

- 8 integrated tables to manage loan origination, customer relationships, and servicing.

- Access to over 1.5 hours of my instructional videos on how to use the lending features I've designed in Airtable.

- Works on the Free version of Airtable - only upgrade if you want to add additional features.

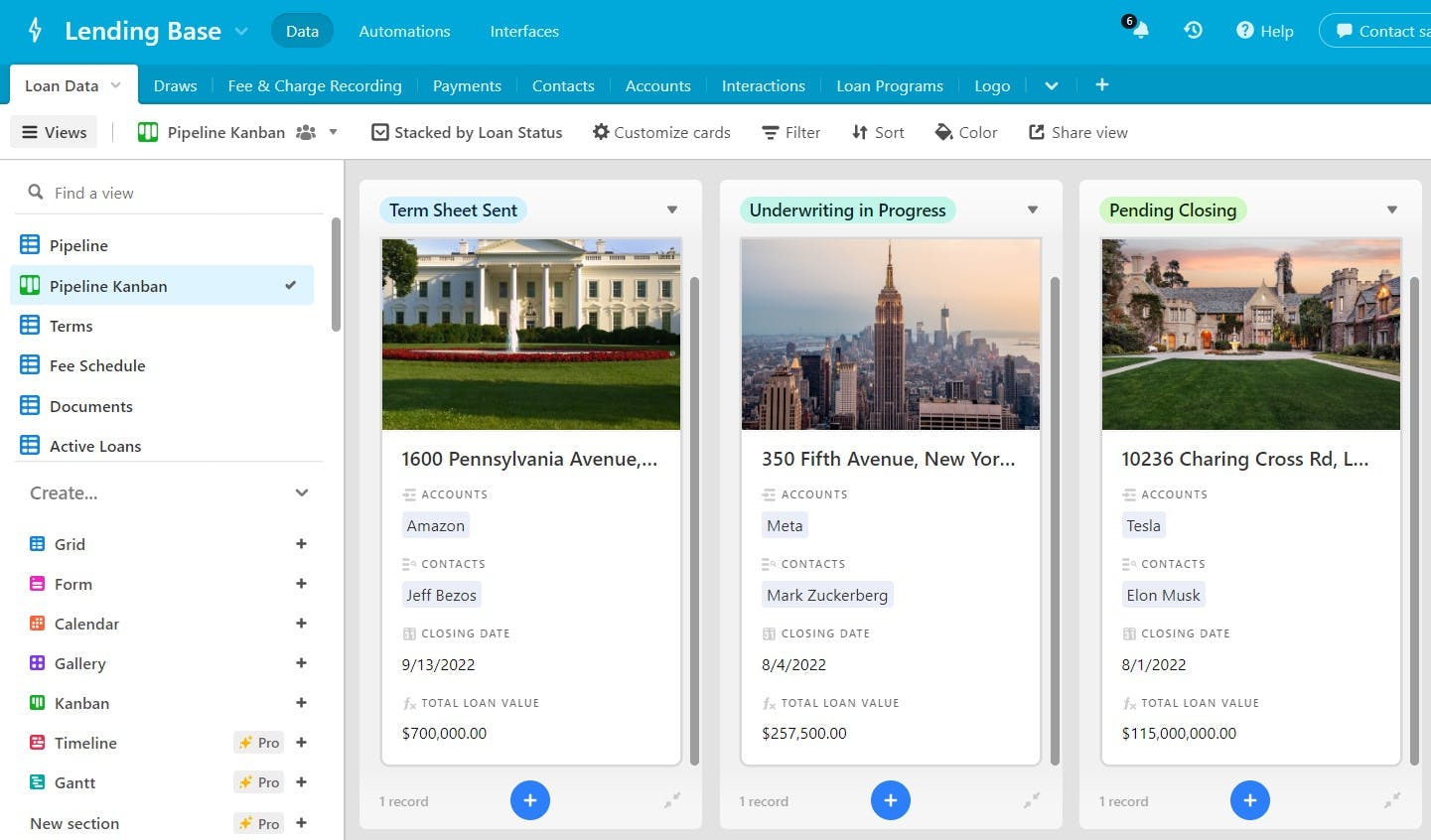

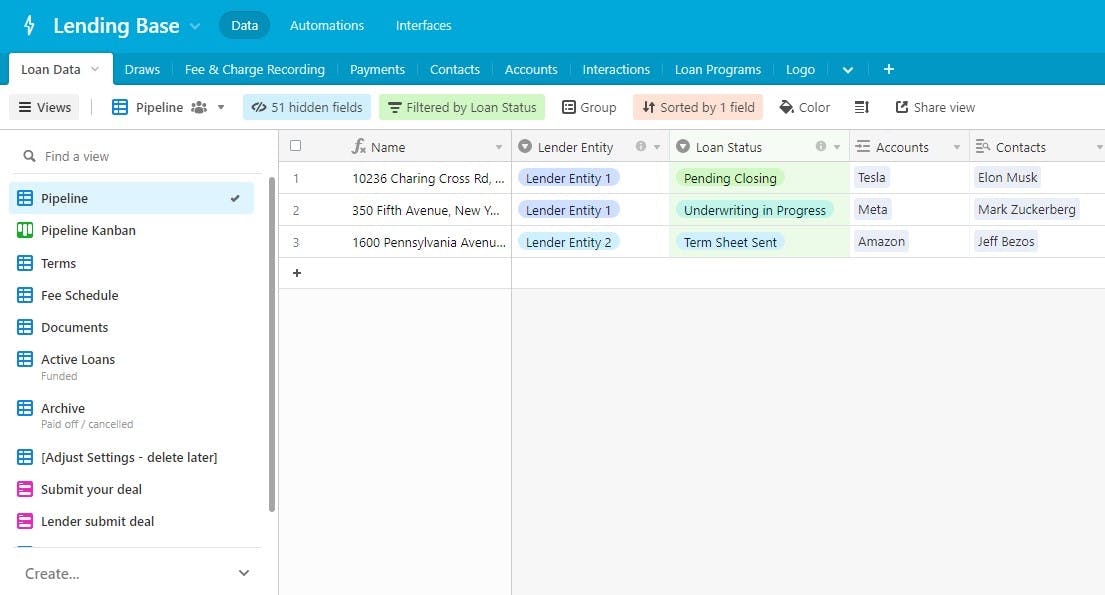

Origination, Servicing, & CRM

Overview of the Private Lending Airtable Base

The base has 8 tables to help you manage your originations, customer relationships, and servicing.

-

Loans

- Morbi viverra dui mi arcu sed. Tellus semper adipiscing suspendisse semper morbi. Odio urna massa nunc massa.

-

Draws

- Morbi viverra dui mi arcu sed. Tellus semper adipiscing suspendisse semper morbi. Odio urna massa nunc massa.

-

Fee & charge recording

- Morbi viverra dui mi arcu sed. Tellus semper adipiscing suspendisse semper morbi. Odio urna massa nunc massa.

-

Payments

- Morbi viverra dui mi arcu sed. Tellus semper adipiscing suspendisse semper morbi. Odio urna massa nunc massa.

-

Contacts

- Morbi viverra dui mi arcu sed. Tellus semper adipiscing suspendisse semper morbi. Odio urna massa nunc massa.

-

Accounts

- Morbi viverra dui mi arcu sed. Tellus semper adipiscing suspendisse semper morbi. Odio urna massa nunc massa.

-

Interactions

- Morbi viverra dui mi arcu sed. Tellus semper adipiscing suspendisse semper morbi. Odio urna massa nunc massa.

-

Loan programs

- Morbi viverra dui mi arcu sed. Tellus semper adipiscing suspendisse semper morbi. Odio urna massa nunc massa.

Start lending with the Airtable Base today.

Frequently asked questions

- Can I build an Airtable lending base myself?

-

Sure - but you'll make mistakes. I've learned a lot in the 3 years I've been using Airtable to run my business. This template includes all those hard fought lessons I've learned over the years.

- Is this only for real estate lenders?

-

It's designed for real estate lenders, but it can be used for any asset class with some minor modifications. That's the beauty of Airtable.

- Can I return it?

-

Unfortunately, no. So, please make sure this is the right solution for you. If you want help deciding, book a 1-hour call with me on the consulting page. If you decide to buy the lending base, I'll give you a credit back for the call.

- Is this ready to use right away?

-

Yes! I won't put you through a month of onboarding! All you have to do is adjust some settings which I specify in the how-to videos. If you have active loans, I also explain how you can import them.

- Is this better than private lending software solutions?

-

Yes and no. This option isn't for everyone. If you have a large operation, want full control of servicing, and manage a fund, you are probably best signing up for software or staying put. This is a great option for lenders that want more flexibility and control, or those that are still operating on a spreadsheet.