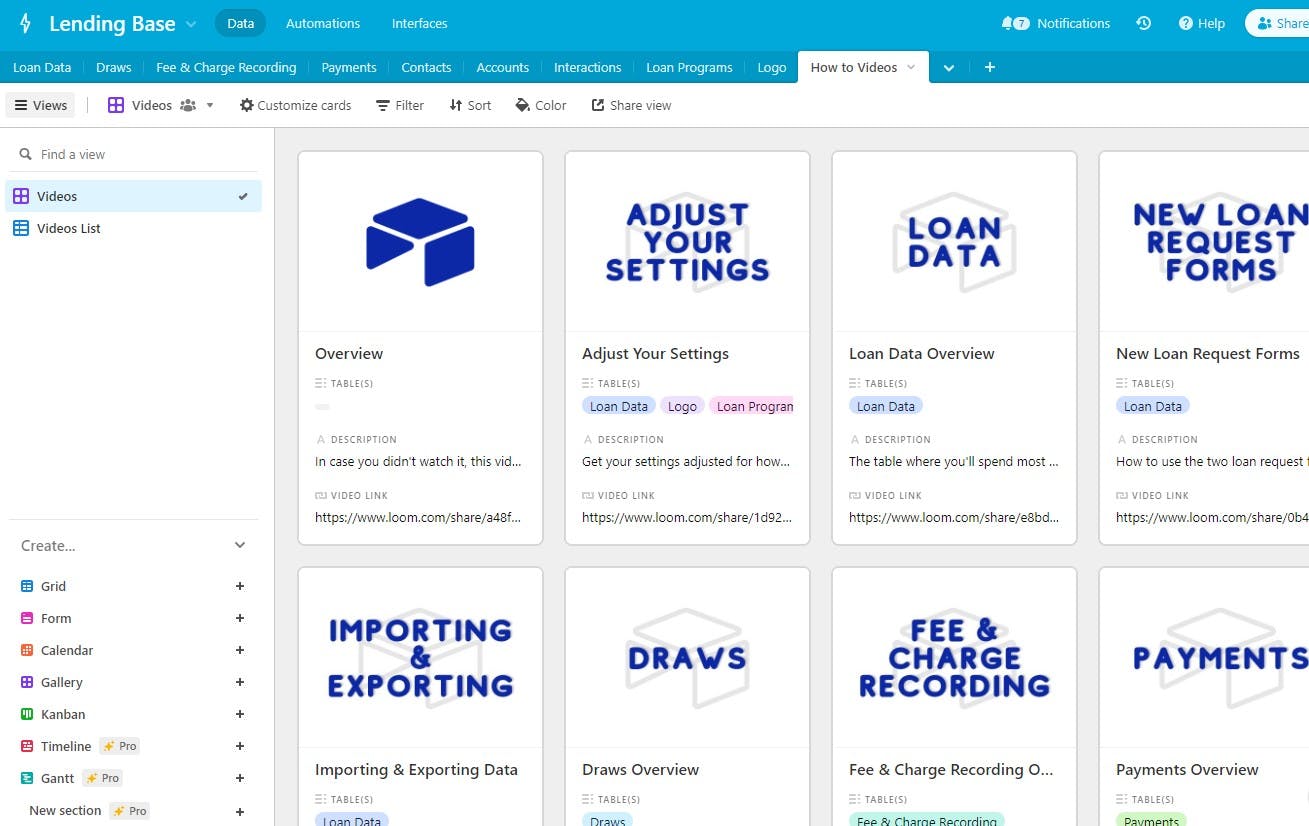

Features to enhance your private lending business

The Airtable private lending base includes features to manage all parts of your business: orignation, servicing, and customer relationship management.

Origination Features: Streamlined and Efficient

Embarking on a new era of loan management

In the fast-paced world of private lending, efficiency and accuracy are paramount. Our Origination features are designed to transform the way you manage loan submissions, ensuring that both lenders and borrowers experience a seamless, intuitive process. Here's a glimpse of what the base offers:

- New loan submission form: Simplify the loan application process with a user-friendly form that captures essential details from both lenders and borrowers, fostering a smoother start to the lending journey.

- Data entry and file storing: Say goodbye to cumbersome paper trails. Our system allows for effortless uploading of underwriting documents, organizing everything in one accessible location.

- Automatic calculations: Minimize manual errors with automated calculations for critical loan aspects like the first payment date and origination fees, ensuring accuracy and saving time.

- Pipeline management with Kanban view: Visualize your entire loan pipeline with our intuitive Kanban view. This feature allows for effective tracking of loan stages and enhances overall workflow management.

- Customizable loan types and products: Cater to a diverse range of lending needs with customizable loan types and products. This includes options for adjusting interest days (360/365) and selecting between Dutch or non-Dutch interest calculations.

- Standardized loan conditions: Implement uniformity and clarity in your loan terms with standardized conditions, including interest rates and maturity dates, for consistency and ease of understanding.

- Custom dashboards: Monitor your lending business with tailored dashboards, providing a comprehensive overview of key metrics and insights at a glance.

- Funding figures generation: Coordinate effortlessly with title companies using our tool to generate and confirm funding figures, streamlining the closing process.

- Funding figures generation: Interest management: Our system ensures that partial interest is prepaid at close, with accrued interest seamlessly due on the first of every month, simplifying financial tracking and management.

Servicing Features: Streamlined and Efficient

Optimizing loan management

Our Servicing section offers a focused set of tools aimed at simplifying and enhancing key aspects of loan management. While not exhaustive, these features are carefully chosen to address vital needs in the loan servicing process, providing streamlined solutions without overwhelming complexity. Here's what you can expect:

- Draw request form for borrowers: A straightforward form enabling borrowers to easily submit draw requests, streamlining the initial step in funding disbursement.

- Draw review, approval, and tracking: Efficiently manage and monitor the draw process from start to finish, ensuring timely approvals and clear tracking of each request.

- Monthly payment tickets generation: Automate the creation of payment tickets, simplifying the monthly billing cycle and helping you stay organized with interest payment tracking.

- Post-close fee addition: Conveniently add and manage additional fees that arise post-closing, such as extensions and late fees, keeping financial records accurate and up to date.

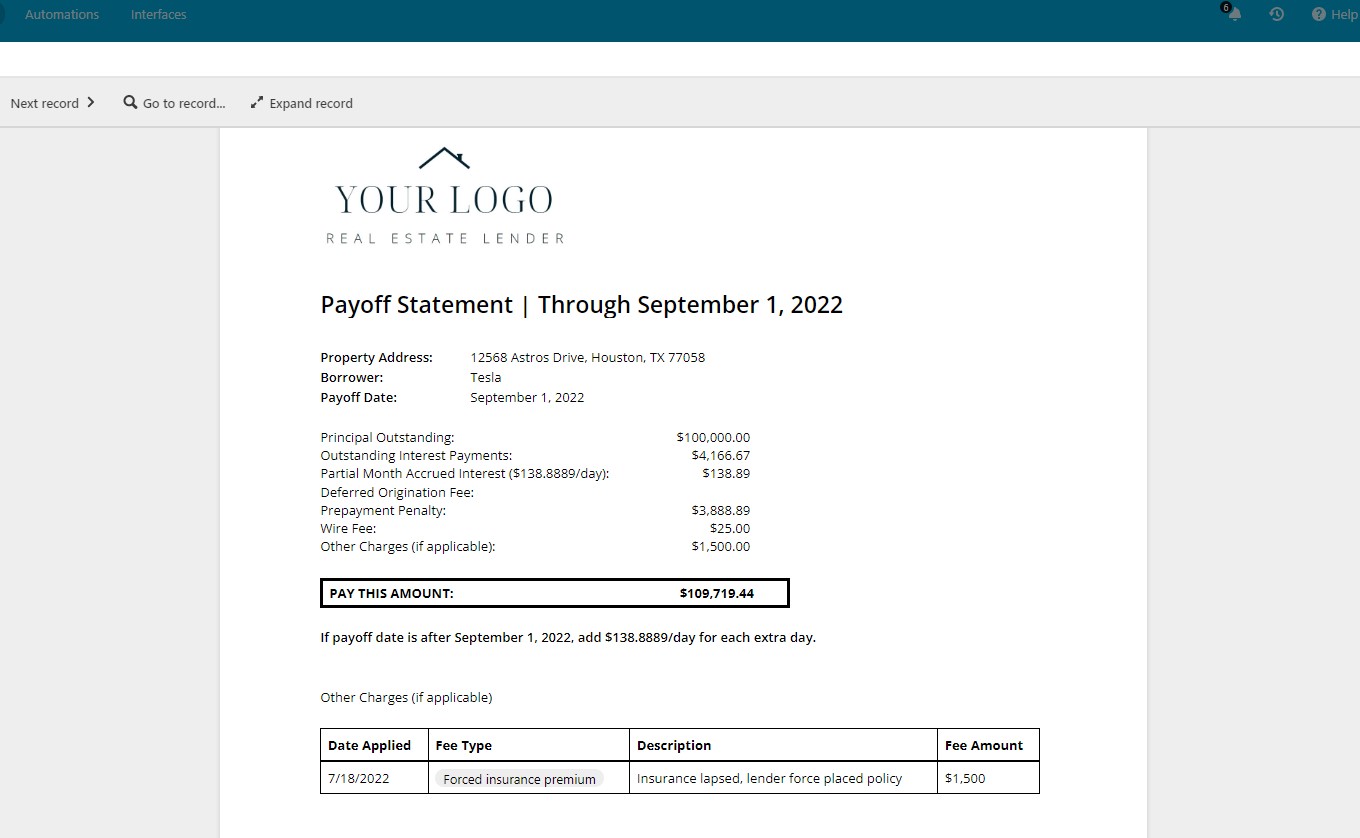

- Payoff statement generation with automatic calculations: Generate accurate payoff statements that automatically include calculations for partial interest, unpaid interest, and other fees, ensuring clear and precise financial settlements.

- Customizable views and dashboards: Monitor essential aspects of your loans with customizable views and dashboards, providing a focused overview of loan performance without overwhelming detail.

- Loan tape generation and Excel export: Create loan tapes and export data to Excel for efficient analysis and reporting, offering a streamlined approach to data management.

Start lending with the Airtable Base today.

CRM Features: Enhanced Connectivity and Management

Empowering effective customer relationships

In our CRM section, we offer a suite of tools specifically designed to empower more effective management of customer relationships. These features facilitate enhanced connectivity with clients, both new and existing, streamlining your interactions and fostering stronger relationships. Discover how our CRM capabilities can transform your approach:

- Seamless integration of new and existing contacts: Easily incorporate new contacts into your database and effectively manage your existing clientele, ensuring all customer information is up-to-date and readily accessible.

- Intuitive contact submission and pre-approval forms: Utilize user-friendly forms for new contact submissions and pre-approvals, simplifying the lead screening and onboarding process.

- Detailed interaction logging: Keep a comprehensive record of all interactions with each contact, capturing essential project details and building a robust history of communications.

- Proactive contact engagement reminders: Set reminders to maintain regular and meaningful contact with your clients, enhancing the quality of your professional relationships.

- Monitoring communication frequency: Track the frequency of your interactions with borrowers, ensuring you maintain consistent and timely communication.

- Linking multiple contacts to single accounts: Associate multiple contacts with a single entity within your Accounts section, providing a well-rounded view of all related interactions.